Guide to Creating Paperless Accounting Firm

Take your accounting firm paperless with these tips.

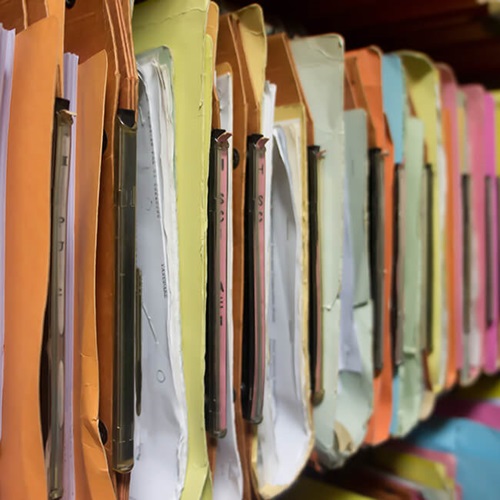

Balance sheets, income statements, cash flow statements, administrative paperwork — accounting firms use a lot of documents. But they don’t necessarily have to be printed.

Businesses across all industries are opting for smarter, paper-free solutions, and the accounting industry, in particular, has a lot to gain from going paperless. Learn why and how to create paper-free accounting processes with our guide to paperless accounting firms.

Why Accounting Firms Should Go Paperless

Sustainability

The most obvious reason for going paperless in any business is sustainability, and this hits especially close to home for accounting, which prints the third largest amount of any industry (following the legal and medical industries). A study by PrintAudit found that each employee at an accounting firm prints an average of 35.5 pages per day.

Based on that average, an accounting firm with five employees would take less than three months to print 10,000 pages — the equivalent of a small tree. Imagine how many trees a larger accounting firm could go through in the same amount of time.

Expenses

Printing less means saving money, and no small amount of it: One report estimates that the accounting industry wastes £11 million (or $14.35 million) through inefficient printing every year.

Accounting firms can recuperate a great deal of that amount by going paperless. The Environmental Protection Agency reports that paper-free offices save $80 per employee annually on costs related to printer and copy paper, toner and ink, postage, and file storage. These costs quickly add up for accounting firms with many employees.

Efficiency

Working with physical records takes an unnecessarily large amount of time: printing, filing, and later searching for documents — not to mention repeating this process whenever a document needs to be updated. This entire process can be reduced to a few mouse clicks with paperless accounting solutions.

According to accountant Gregg Bossen, scanning takes less time than filing for bookkeeping, but “[t]he real-time savings come later when a vendor calls and asks about a bill. It takes much longer to get up from a desk and go rifling through files to find the paper copy of a bill than to simply click on it.”

Related: Understanding the Importance of Records Management

Space

Document storage could make up as much as 25% of your accounting firm’s office space. In addition to being a large overhead cost, this storage could prevent your firm from expanding or overly clutter the office. Some accounting firms end up having to lease off-site storage space, further adding to costs.

Going paperless, on the other hand, may even allow your firm to move into a smaller office space by eliminating those bulky file cabinets.

Access

Storing documents in the cloud give you instant access to the information you need from anywhere, allowing for flexibility that isn’t possible with paper-based firms.

For example, one of eFileCabinet’s accounting clients travels a lot for work and didn’t enjoy lugging all of their paperwork around. “Checking multiple bags for all of their paperwork was exhausting and expensive,” they remarked. “Paperless systems helped me to lose that ball and chain because I carried my entire office right on my laptop.”

The same flexibility helps if you’re at an off-site meeting and found you’ve forgotten a file you need to reference. Rather than delaying your meeting or having someone fax you the file, you can simply log in and pull up the file on your laptop.

Image

Going paperless can improve your accounting firm’s image in multiple ways. On the most basic level, doing so will free your office of clutter, which can create an unfavorable impression on clients and other visitors.

However, your accounting firm’s brand image is equally important. Going paperless signals to your current and prospective clients that your firm is a sustainably minded, forward-thinking, and technologically advanced business.

Security

Documents stored on the cloud are much safer than their physical counterparts, both from incidents such as storms or fires and from theft. Digital documents are protected using multiple security solutions, encrypted, and restricted to trusted users who have been granted access. As one accountant put it,

“Before, anyone with keys could access any paperwork from any client, whether it was needed for their job or not. But with my document management system, I can set user permissions that restrict who has access to what without sacrificing on efficiency. That means I can view everything my clients send me, while my secretary can access the contact information she needs to do her job correctly.”

Related: Complete Guide to Going Paperless

How to Make Your Accounting Firm Paperless

Identify Opportunities

Review your various business processes and consider which use the most paper, which may cause problems if they are held up, and which could easily be digitalized. The best opportunities for digital transformation are those that use significant amounts of paper and present fewer obstacles, and even if your firm eventually plans on digitalizing everything, this is where you should start.

For example, paperless billing and invoicing are easy to set up and allow you to eliminate recurring paper usage.

Establish New Processes

New processes will be in order, both to dictate how to handle paper documents and to prevent paper documents from being created unnecessarily.

Your plan should start with where to store your files (a cloud-based data storage solution or file server data storage is ideal) and how to organize them, including naming and filing conventions. Then set up users and grant them the proper security permissions. You may also want to enable password protection for files that contain sensitive client data.

Create best practices for collaboration and versioning to ensure that everyone is always referencing the right file.

To prevent your staff from creating paper documents in the future, implement processes such as e-signatures, paperless expense reporting, and paperless financial statements and reports. The more you can avoid creating paper in the first place, the less you’ll have to scan later.

Invest in the Right Tools

Your processes won’t work without the right tools to support them, so start considering what you need while making your plans.

An effective document management system is crucial to any paperless accounting firm, serving as a digital hub for all your documents. Document management systems make it easy to keep documents organized by indexing files as they’re loaded. When choosing a document management system for your accounting firm, prioritize features such as index and search, optical character recognition (OCR), and email management so that you can categorize documents regardless of the file format.

You’ll also need to choose a quality scanner, both to take care of the existing paperwork in your office and to handle the (hopefully smaller amount of) paper that’s generated in the future.

When choosing a scanner, consider your accounting firm’s specific needs. For example, if your firm is on the small side and plans to scan no more than 10,000 pages per day and 60 pages per minute, the Kodak i2900 Scanner could be a suitable choice. However, the Kodak i3450 Scanner would be more fitting for larger accounting firms requiring up to 30,000 pages per day and 90 pages per minute.

Whatever scanner you choose, you’ll want to set it to automatically save your files to your document management system or shared data location to save your staff time.

Finally, shredders will enable you to dispose of physical copies your firm no longer needs while ensuring client confidentiality. Be sure to create a system to organize any archives that you need to keep on hand.

Related: How to Choose the Best Scanner for Your Office

Strengthen Security

In order to take advantage of the increased security that cloud storage offers, you need to put the proper security measures in place. In addition to partnering with a trusted cloud provider that has existing IT policies and infrastructure in place, your accounting firm will want to implement:

- Access permissions and restrictions: Your document management system should allow you to limit access to documents on a folder or even file-level or by team or role, so you can ensure that only those who need to see a file can access it.

- Secure portals: Never send sensitive information over email. Instead, use a secure portal that encrypts the information throughout the entire exchange.

- Multifactor authentication: Phishing scams could cause both staff and clients to compromise their passwords. Multifactor authentication prevents unauthorized access by requiring extra verification before granting access to the system.

Ensure Compliance and Eliminate Risk

Compliance is a concern for any accounting firm, but a few measures can help your firm adhere to regulations and reduce risk:

- Data backup: Regularly back up your data to prevent loss in the case of accidental document deletion, system failure, or whatever else might happen. Backing up your data allows you to quickly restore lost files.

- Audit trails: Keep track of who has done what to a file by choosing a document management system that tracks each document’s history. Audit trails allow for accountability in the case that something goes wrong.

- File retention policies: Accounting firms should only retain documents for as long as they are useful or until they’ve met the legal requirement — storing files improperly could lead to lawsuits and liability claims. When creating file retention policies, consider:

- State rules: The regulations put forth by the Boards of Accountancy vary by state.

- Contractual requirements and regulations: Your firm may need to adhere to special retention policies if you work with government-regulated or -funded clients.

- Rules of discovery and statutes of limitation: Your documents or state may require specific rules of discovery or statutes of limitation. Consulting with an attorney is the best way to ensure your firm doesn’t overlook anything.

Update and Train Your Staff

Rather than just announcing that the firm is going paperless, explain why you’re doing so. Getting your staff on board and invested in the change will increase the adoption rate.

Next, train your staff on the processes you’ve established, including naming and filing conventions, document intake, back-filing, and navigating your document management system.

In fact, you may even want to get their input while you’re still shaping the new processes — they’ll be the ones carrying them out, after all.

Curtail Paper Habits

No matter how hard you try, old habits die hard. For example, printing a financial statement may be more of an automatic response than a conscious decision.

To discourage paper habits, making it inconvenient for your firm’s staff to use paper however possible, such as by:

- Disabling printing functions on office computers

- Providing dual monitors to give staff additional space to review documents

- Eliminating copiers, fax machines, and fax printers

- Registering for paperless billing statements

After a while, paperless accounting processes will become the new habit, and you’ll be well on your way to a paperless accounting firm.

Update Your Clients

Once you’re finished taking your accounting firm paperless, let your clients know — both to inform them of how this change will affect them and as a PR opportunity. Explain why your firm is making this change and what clients can expect and address any security concerns they may have.

Insights and Case Studies

Understanding the Importance of Records Management

By Kara Rayburn, Global Manager, Portfolio Marketing & WebLearn why records management is crucial to the success of your business, and then get started with these three simple steps.

How to Choose the Best Scanner for Your Office

By Kara Rayburn, Global Manager, Product Marketing & WebLearn to choose the best office scanner - evaluate scanning needs, select the right scanner type, and consider features like OCR to make the right choice.

Guide to Going Paperless

The value of transitioning your enterprise into a digital world and how to do so

Related solutions

S2085f Scanner

85ppm | 300 Sheet ADF- Tough, high capacity A4 scanning

- Surepath™ intelligent document feed technology

- Integrated A4 flatbed

- Dual Light Illumination (DLI)

Related Challenges

ABOUT THE ALARIS DIVISION OF KODAK ALARIS

Kodak Alaris is a leading provider of information capture and intelligent document processing solutions that simplify business processes. We exist to help the world make sense of information with smart, connected solutions powered by decades of image science innovation. Our award-winning software, scanners, and professional services are available worldwide and through our network of channel partners.

Partners

Privacy Notice | Legal / Site Terms | California Notice at Collection | Do Not Share My Personal Information

© 2024 Kodak Alaris Inc. TM/MC/MR: Alaris, ScanMate. All trademarks and trade names used are property of their respective holders. The Kodak trademark and trade dress are used under license from Eastman Kodak Company.